Oil & Gas models Start the discussion!

What is Oil and Gas financial modeling?

Financial modeling in the Oil and Gas Industry is the process whereby one creates a Net Asset Value tool for an energy project or asset. The objective, as with all financial modeling, is to estimate the financial performance of a company's project. This, in turn, helps to generate a predicted value for an Exploration and Production (E&P) segment.

What is the structure of the Oil and Gas Industry?

The Oil and Gas industry is comprised of a range of different company types, some of which include:

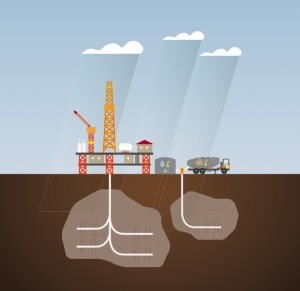

Upstream Companies: This segment of the Oil and Gas industry, which is also named the Exploration and Production sector, sources and extracts minerals and resources from the ground. These companies also involve themselves in related areas, such as feasibility studies.

Midstream Companies: This type of company involves itself in the transportation and storage of oil, gas and other resources; this is done largely through pipelines and gathering systems. The midstream sector of the Oil and Gas industry provides what is an essential intersection in order for the upstream companies to link with those entities downstream.

Downstream Companies: Also named Refining and Marketing (R&M) companies, downstream organizations turn the crude oil and other resources into marketable commodities, such as gasoline and fuel. This is then sold to the consumers for use.

Oil Field Services: This type of company is involved with drilling companies, assisting the creation of oil and gas wells. More specifically, they take part in the surveying of the land to be drilled into, testing the structure underground (seismic surveys). Additionally, they provide services to move rigs, both in land and water, whilst also helping to correctly drill into the ground.

Integrated Majors: This type of company takes part in almost all aspects of the different segments included within the oil and gas industry. The vertically integrated companies, also-known-as 'majors', are the most well-known of the companies within the industry due to their great market value.

Why is Oil and Gas financial modeling different?

There are a range of reasons as to why Oil and Gas financial modeling is different, some of reasons include:

Lack of autonomy surrounding price and revenue: These two aspects are out of the hands of companies, meaning that they cannot control them.

Balance Sheet Importance: For Exploration and Production companies, the balance sheet is extremely important as it contains the reserves that will be used for revenue generation in the future.

Asset Depletion: Unlike for other companies, assets for businesses in the Oil and Gas industry are depleting. As these organizations produce more assets and earn more revenue, their assets decline as they use up the resources found underground.

Price cycles: Oil and Gas companies have to follow the cyclical nature of the industry regarding commodity prices.

To find out more about Oil and Gas Financial modeling, please visit these webpages: