Originally published: 04/07/2017 09:06

Last version published: 04/07/2017 09:10

Publication number: ELQ-66326-2

View all versions & Certificate

Last version published: 04/07/2017 09:10

Publication number: ELQ-66326-2

View all versions & Certificate

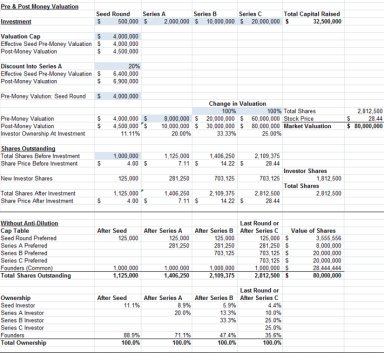

Financial Model: Various Rounds of Investment Affecting Ownership, Waterfall Analysis, and IRR/Return Multiple Analysis

Excel Financial model for entrepreneurs looking to raise capital