Originally published: 02/05/2017 14:04

Last version published: 04/05/2017 14:31

Publication number: ELQ-45240-3

View all versions & Certificate

Last version published: 04/05/2017 14:31

Publication number: ELQ-45240-3

View all versions & Certificate

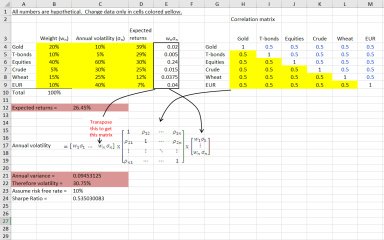

Portfolio Variance Model

A simple model to learn and play with portfolio variance in Excel