Last version published: 25/10/2016 10:18

Publication number: ELQ-37853-2

View all versions & Certificate

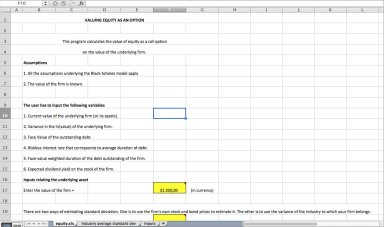

Valuing Equity as an Option

An option pricing program to value the equity in a firm

Prof. Aswath Damodaran offers you this Best Practice for free!

download for free

Add to bookmarks

Further information

Outputs:

- Value of equity as a call

- Value of outstanding debt

- Appropriate interest rate for debt

- Risk neutral probability of default

Assumptions:

1. All the assumptions underlying the Black-Scholes model apply

2. The value of the firm is known.