Fundamental Analysis Models Start the discussion!

What is Fundamental Analysis (FA) ?

Fundamental Analysis (FA) is a method of evaluating a security’s intrinsic value by examination of related economic and financial factors, both qualitative and quantitative. In other words, Fundamental Analysis is a method of determining a stock’s real or “fair market” value.

Fundamental Analysis (FA) is one of two major methods of market analysis in analysis-related stock trading: Fundamental Analysis and Technical Analysis.

How do you calculate Fundamental Analysis? Tools of Fundamental Analysis

Fundamental Analysis of stocks includes estimations based on many factors related to the stock, such as: financial information and management commentary, company financial statements, press releases, trade agreements and external politics, company customers and suppliers, the global industry and many more. They can be divided into Quantitative and Qualitative Fundamentals:

- Quantitative Fundamentals:

Balance Sheet, Income Statement, Statement of Cash Flows (including Cash from investing, Cash from financing and Operating Cash Flow),

- Qualitative Fundamentals:

Business Model, Competitive Advantage, Management, Corporate Governance.

What is the difference between Technical and Fundamental Analysis?

Fundamental Analysis relies on company’s parameters (or fundamentals). It takes into consideration multiple current factors that may be influencing the securities’ price and may have an impact on the value in the future.

Technical Analysis ignore the fundamentals in favor of studying the historical price trends of the stock. Technical analysts use charts and other tools to trade on momentum and base their investments on the price and volume movement of stocks. They believe that the market already discounts for everything so all news about the company is priced into the stock. Pure technical analysts try to find historical patterns for recognizing future behavior.

Pros and Cons of Fundamental Analysis

- Pros of Fundamental Analysis:

• it helps traders and investors to gather the right information to make rational decisions about what position to take,

• it limits the chances of falling for personal biases,

• it seeks to understand the value of an asset in order to provide traders with a much longer-term view of the market,

• it aims at profiting from the market correction.

- Cons of Fundamental Analysis:

• it can be time consuming as it requires multiple areas of analysis,

• it takes a much longer-term view of the market so its results are not the most suitable for quick decisions related to the short-term oriented behavior,

• it provides a well-rounded view of the market, without underlying the importance of the best and the worst-case scenario.

How to Invest with Fundamental Analysis

Fundamental Investing and Fundamental Trading have their rules. The stock is said to be undervalued when the stock’s intrinsic or fair market value is higher than the current price on the market. In such case, a “buy recommendation” is usually issued as the price is likely to go up in the near future. Contrarily, if the fair market value is lower than the price on the market, it means that the stock is overvalued and selling the stock is recommended as a downward trend is to be predicted.

Examples of Fundamental Analysis

You can find detailed examples of Fundamental Analysis under the following links:

- Detailed Example of Fundamental Analysis: Amazon

- Detailed Example of Fundamental Analysis: Coca-Cola

Read more on the topic of Fundamental Analysis

The Top Tools of Fundamental Analysis

Most popular Models

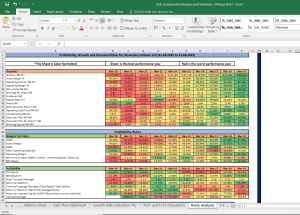

Completely editable and formula-based Valuation Excel Model for HUL Shares4,000Discussadd_shopping_cart$5.50

Completely editable and formula-based Valuation Excel Model for HUL Shares4,000Discussadd_shopping_cart$5.50 by Valuation

by Valuation

Infosys Shares Complete Fundamental Analysis

Fundamental Analysis in Microsoft Excel of Infosys Shares2,1471add_shopping_cart$3.50 by Valuation

by Valuation

Apollo Hospitals Enterprise Shares Complete Fundamental Analysis

Fundamental Analysis in Microsoft Excel of Apollo Hospitals Enterprise Shares61Discussadd_shopping_cart$3.50 by Valuation

by Valuation

Mindtree Shares Complete Fundamental Analysis

Fundamental Analysis in Microsoft Excel of Mindtree Shares487Discussadd_shopping_cart$3.50 by Valuation

by Valuation

Adani Enterprises Shares Complete Fundamental Analysis

Fundamental Analysis in Microsoft Excel of Adani Enterprises Shares40Discussadd_shopping_cart$3.50 by Valuation

by Valuation

MCX Shares Complete Fundamental Analysis

Fundamental Analysis in Microsoft Excel of MCX Shares320Discussadd_shopping_cart$3.50 by Valuation

by Valuation