Raising Capital tools 1 comment

What is Raising Capital?

Raising capital can be one of the biggest challenges when starting a new business. The need for raising funds is not something that only occurs in the start of the lifetime of the firm, but it is a continuous activity to finance growth. For that very reason, you will need to be very strategic and realistic of where and when you are going to use it.

To start off with your start-up investment:

Firstly, you need to get all the right ingredients before raising funds. You need to gather all your ideas, goals and strategies and put them in a single document called the “Business Plan”.

With a startup business plan, the aim is to give deeper thinking into your startup. It should help you develop a better idea of the present and the future state, the struggles you may come across and the solutions you will use to solve the different challenges your business will face. Additionally, the startup business plan will force you into the research required around your startup.

If you would like to download a sample startup business plan template to customize to your business click on here: Best Startup Business Plan Templates

Giving figures when raising capital:

When asking for enough money from investors, you will need to have well backed-up sources. The business plan will address the identification of your activities, but you will also need the quantification of what will be needed to achieve your goals.

In other words, this means the inclusion of financial model. A startup financial model should be the source of the numbers you give to your investors when raising funds. It should be inclusive of an income statement, balance sheet and a statement of cash flows. The aim with this is to have both the past performance on the excel model as well as the future projections. In this way the investors are aware that you have derived your propositions from a well calculated source.

If you would like sample startup financial model templates to customize to your business click on here: Best Startup Financial Model Templates

To increase your chances when raising funds:

To achieve a successful fundraising, you will need to address your investors accordingly. This means, you need to have a pitch and a pitch deck which will inform and persuade your investors enough to get into the first step of collaborating with you and investing money in your company.

The pitch deck will give an idea of why your company and your team is worth investing capital in. You need to convey your message in a way that you is realistic, knowledgeable, distinct and trustworthy.

If you would like sample pitch decks to customize to your business click on here: Best Sample Pitch Deck Templates

What happens in fundraising?

There are a number stages to fundraising, which divide the process into funding rounds.

They are the following:

->Seed Round: Small amount of money given for momentum, specifically to produce its first product.

->Series A: Once the product has been made, the business looks towards a VC group who will bring the product to the market. This is usually inclusive of an exchange to a portion of the company.

->Series B: At this stage, the product and business model have been established. Here the aim is to bring the product to a much larger market.

- ->Series C: Expansion to overseas markets or diversification of the product to other platforms.

Each round for raising capital will be inclusive of a giveaway of one of your business’s portions for your investors. Hence, you need to be strategic about your growth or else you won’t have much to offer to investors.

All in all, your investors will focus on specific growth points. This means that you need to track your firm’s performance and focus on your goals- in this way, you can keep your business in line with their demands and increase your chances of raising capital.

Who can fund your startup investment?

There are a number of sources from which you can raise capital for your startup. They can be the following:

Crowdfunding: A rather more recent way of funding a startup. In crowdfunding, the entrepreneur will put up the information/goals of their business and have people give money into it if they are fans of the idea. Crowdfuding is similar to a donation, which not only brings necessary financing, but also marketing.

Angel Investment: Angel investors with a surplus of funds usually are interested in investing in upcoming startups. They can come as Angel Investor groups or as individuals.

Venture Capital: Venture capital focuses of funding firms with great potential. They are professionally managed funds that invest in return of equity, and exit once there is an IPO or acquisition. Venture Capital is useful for firms who can already generate their own revenue and which do not need much time to make their product big in the market.

** Startup Studios, Incubators, Accelerators:** This is a good option for early stage businesses who need the assistance and attention to aid growth. Incubators will nurture the business, whereas the accelerators will help the business take big leaps.

Government programs: Some governments establish funds dedicated to providing startups with capital necessary to boost innovation. These can be catered from early stage businesses to middle stage businesses. Usually, there is an eligibility criteria that has to be met for to get the necessary capital.

Microfinance: This is dedicated for firms who lack the access to the conventional banking services, as their capital may be inadequate and credit ratings may not be as high.

For more information on Raising capital, feel free to have a look at the following links:

Most popular tools

Cap table for capital raise / buy in - by out and investor IRR and investment multiple forecast3,610Discussadd_shopping_cart$10.00

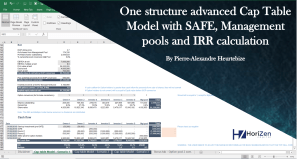

Cap table for capital raise / buy in - by out and investor IRR and investment multiple forecast3,610Discussadd_shopping_cart$10.00 by HEURTEBIZE

by HEURTEBIZE

Multiple rounds Cap Table including Safe, pro-rata rights and Management Option Pool

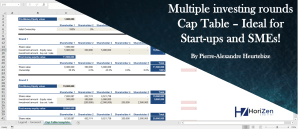

Multiple rounds cap table including SAFE conversion, Management option pool and investment performance (IRR) 3 scenarios1,405Discussadd_shopping_cart$39.00 by HEURTEBIZE

by HEURTEBIZE

SAAS Financial Model Template

Dynamic 5-year SAAS forecast template for fundraising715Discussadd_shopping_cart$99.00 by numberslides

by numberslides

Startup Pitch Deck Template & Guide

Deck Template and Guide for how to attract investors (focused on Seed and Series A)1,4731add_shopping_cart$50.00 by Evan Diaz de Arce

by Evan Diaz de Arce

The Ultimate Fundraising & Investor Guide

This fundraising and investor guide offers unique insight into the startup ecosystem for founders and investors.345Discussadd_shopping_cart$19.00 by Chris Pret

by Chris Pret

How to Raise Capital

Detailed Excel model for helping to raise capital for your business.234Discussadd_shopping_cart$5.00 by David Connaughton

by David Connaughton