Payroll Templates Start the discussion!

What are Payroll Templates?

Payroll Templates make for a useful organisation tool for any company in monitoring its payroll expenses. Payroll templates easily and accurately calculate the amount each employee in a company is to be compensated on their pay day. The templates allow for extra data that would alter the final payment amount to be easily inputted. This includes influences that increase this amount (e.g. bonuses, expenses, reimbursements) as well as deductions (e.g. tax rates).

Different Types of Payroll Templates:

Payroll templates come in all shapes and sizes. They can be designed to suit any company depending on what additional data (bonuses, tax rates, etc.) is required in calculating their employees’ final payments. They most commonly vary depending on the intervals at which the employees our paid. The most used are bi-weekly Payroll templates and monthly Payroll templates however payroll templates for more regular time intervals, like daily and weekly ones are also used.

Benefits of Payroll Templates:

One of the two main benefits is that their use increases efficiency. Calculating each individual employee’s total payment without a payroll template can make for a very time-consuming task. It becomes increasingly time consuming the more employees a company has and the more variables there are that influence the final amount to be compensated to the employee (bonuses, refunds, fines, etc.). The time-consuming nature of the task can result in employees not being paid on time, which can lower morale and performance and can sometimes even ends in legal issues, none of which is good for the prosperity of the business. For medium sized businesses it is an indispensable tool but no matter how small your company is, insofar as you have employees payroll templates will save you time on their salary calculations, time that could be more effectively spent elsewhere.

The second of these benefits is they are far more accurate. When inputting multiple variables into an equation to calculate an employee’s salary, the calculations can become complicated leaving plenty of room for mistakes to be made. Do this multiple times and you’re bound to make a mistake at some point. With payroll templates, the possibility of human error is removed and, insofar as the initial data entered into the template is correct, the calculations will be 100% accurate. This will mean avoiding ever paying any of your employees too much or too little. Overpaying your employees means unnecessary loss of money for the business and underpaying your employees can too lower performance and lead to legal trouble.

Disadvantages of using Payroll Templates:

There are no practical disadvantages to using Payroll Templates however they are subject to all the same potential security threats as any other online document containing sensitive data. These include the loss, theft, or exposure of such data.

For more on Payroll Templates:

Most popular Templates

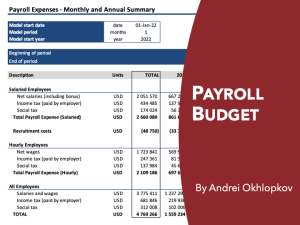

A professional template to budget payroll expenses695Discussadd_shopping_cart$20.00

A professional template to budget payroll expenses695Discussadd_shopping_cart$20.00 by Andrei Okhlopkov

by Andrei Okhlopkov

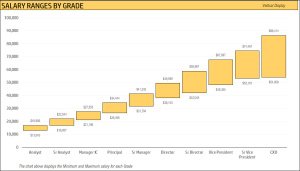

Salary Structure Calculator Excel Template

Create a Salary Structure for your organization within minutes in Excel2,8114add_shopping_cart$30.00 by Indzara

by Indzara

Print mass Checks automatically V02

You need to print mass checks but don't want to get special software? Here is the solution for you!59Discussadd_shopping_cart$50.00 by Andreas Od.

by Andreas Od.

Payroll Sample With Dynamic Salary Slip

Payroll Template with Automated and Dynamic Salary Slip.2,721Discusslibrary_add

Salary Slip Generator with Integration to Outlook

Its a model which automatically creates payslips of employees registered on payroll, in pdf, and email it to respective6801add_shopping_cart

Payroll Calculator for Small Business

User friendly Payroll Calculator Template suitable for small business.144Discussadd_shopping_cart$69.00 by Profit Vision

by Profit Vision