Budgeting Excel templates Start the discussion!

What is budgeting?

To budget is to create a plan for the way that you will save and spend your money. The process of budgeting involves calculating the amount of money you receive, how much you will keep, and where and how the rest of the money will be spent.

This process requires an evaluation of expenses and revenues, and can be carried out by individuals, groups, businesses of varying sizes, and governments.

For a corporate budget, factors such as the economic outlook of the market, projected sales figures and performance, and cost trends may be taken into consideration for both individual department budgets, or the business as a whole as the 'master budget'.

What is the importance of budgeting?

Budgeting is an important aspect for many different people and organizations for a number of reasons. Some of which include:

It ensures, or helps to ensure, that there is no overspending of money that you do not have or cannot afford to spend. You will therefore be able to fund your current financial commitments.

It can help to plan for the future, whether that be saving for something, or formulating where future spending is angled towards in areas such as employees, new equipment, or bonuses.

Budgeting is also important for acting as a safety net. By making a financial plan, you are able to set aside a certain sum of money

What are the different types of budgeting?

There are a two main types of budget, a Static Budget and a Flexible Budget.

Static Budgets: This type of budget includes predicted values set out before the period that is to be budget for has begun. There can be considerable deviation from the actual values at the end of the budget period. A static budget is more useful for those who have more predictable business patterns, with stable recurring revenue or low levels of employee turnover. For business that are more unpredictable the static budget will show a greater disparity with the actual figures, also known as the static budget variance. For more detail on the nature of static budgets, this Investopedia page may be useful

Flexible Budgets: The other main type of budget is the flexible budget. This can be altered when there are changes in volume or activity. This means the budget will vary as the revenue does. There are three different forms of a flexible budget:

- Basic Flexible Budget: where only the expenses that are linked with revenue are altered.

- Intermediate Flexible Budget: This deals with expenditures that impact measures of activity other than revenue.

- Advanced flexible budget: This type of budget will change the expenditure proportions if the target ranges are exceeded for the measurements that were initially in place.

To find ready-to-use budget templates built by excel and finance experts, look below on Eloquens.com. If you can't find what you're looking for, don't hesitate to reach out to authors on the site to see if they can help!

Learn more about budgeting by visiting these webpage links below:

Most popular templates

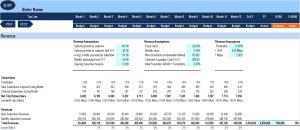

Take control of your business' financials with this Manufacturing Company Budget Template.4,588Discussadd_shopping_cart

Take control of your business' financials with this Manufacturing Company Budget Template.4,588Discussadd_shopping_cart

Budget and Forecast Excel Template

Budget and Forecast Model Interactive Template7,5682add_shopping_cart$99.00 by Steve Lindsey

by Steve Lindsey

Interim Budgeting (Reforecasting)

Tools to depict the mid-year status, estimate if the outlook looks reasonable and assess the accuracy of past forecasts571Discussadd_shopping_cart$20.00 by Andrei Okhlopkov

by Andrei Okhlopkov

Food Manufacturing Budget Excel Template

Food Manufacturing Company Budget Template - take control of your business' financials.2,9951add_shopping_cart

The Financial Planning Excel Workbook

A simple yet powerful tool to jumpstart your financial planning.1,238Discussadd_shopping_cart$20.00 by Rhon De los Santos

by Rhon De los Santos

Budget Template for Internet Service Provider

The template is a statement of estimated income and expenses based on future plans and objectives for Telecom Service1,2263add_shopping_cart$70.00 by ECF Consultancy

by ECF Consultancy