Valuation Model Excel Templates 1 comment

What is valuation?

Valuation is the process of calculating the current worth of an asset or liability. Examples of assets are stocks, options, companies, or intangible assets. Concerning liabilities, they can be bonds issued by a company.

Common terms used when discussing the value of an asset or liability are market value, fair value, and intrinsic value.

Put simply, the value to be derived is the present value of all the future benefits (or cashflow) of the given asset or liability. This can calculated in various ways, with the use of financial and valuation tools, to determine the magnitude and risk of such future benefits. Take the example of an analyst determining the value of a company. He will consider the company's management, the composition of its capital structure, the prospect of future earnings and market value of assets to come to terms with its value.

Valuation Models

There are a range of way to value assets and liabilities, some of which include:

Comparable Company (Comps) Analysis: Also-known-as 'trading multiples', 'peer group analysis', 'equity comps', or 'public market multiples', a Comparable Comps Analysis uses information from similar companies, in terms of size and industry, to reach a valuation on the value of a company. This method bases itself on the assumption that comparable organizations will have similar valuation values.

Precedent Transaction Analysis: This method of valuation analysis looks at the price that has been paid for companies similar in size and industry in the past to help value another company. Similar to the comparable comps analysis, due to the fact it is a relative model, the precedent transaction analysis may deliver an outdated valuation depending on when the merger or acquisition has taken place.

Discounted Cash Flow Analysis: A DCF analysis values the company based on the value of current cash flows in the future. This can be a complex method, requiring high levels of detail and intricacy. A DCF analysis is perhaps most accurate, and therefore useful, for companies with steady levels of income.

Other examples of valuation models include the Leverage Buyout Analysis and the Cost Approach (useful for real estate valuations).

It is common for a variety of valuation models used - the outcomes of each, such as the comparable comps, precedent, and DCF valuation models, to be mapped onto a 'football field chart.' This shows the variations regarding the different valuation outcomes, and then displays the average price.

All in all, Valuation in finance is key for many reasons. It is needed in investment analysis, capital budgeting and acquisitions transactions, financial reporting, or taxable events.

If you'd like some Valuation Excel Model Templates to facilitate your valuation, you will find the above valuation techniques and many more on the Eloquens catalogue. Also, if you have any questions or would like to discuss matters about a given tool, you can contact our authors whom will happily get back to you.

For more in depth information about Valuation, feel free to have a look through these links:

More on Valuation

More on Asset valuation

A more in-depth look at Valuation in general

Most popular Excel Templates

Used by Investment Professionals at Private Equity and IB Firms14,3242add_shopping_cart$180.00

Used by Investment Professionals at Private Equity and IB Firms14,3242add_shopping_cart$180.00 by John Swan

by John Swan

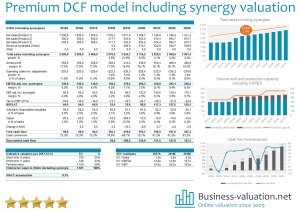

Synergy Valuation Premium DCF Excel Model

A Premium Discounted Cash Flow DCF Model including synergy valuation12,5623add_shopping_cart$49.00

by Patrik Johansson

by Patrik Johansson

10 Years Financial Forecast and Valuation Excel Model

This unique generic financial model allows the user to forecast a Company's profit and loss account, balance sheet, CF4,0484add_shopping_cart$50.00 by Jair Almeida

by Jair Almeida

Hotel Valuation Model (with Business Plan Forecast)

A comprehensive and very flexible Hotel Valuation model that also allows to generate a 5 year business plan.2,9031add_shopping_cart$40.00 by Finance Cell

by Finance Cell

Scorecard - Scoring and Valuation Model

Scorecard / scoring model to help valuation, target assessment and visually see strengths and weaknesses of a business813Discussadd_shopping_cart$5.00 by HEURTEBIZE

by HEURTEBIZE

Discounted Cash Flow (DCF) Valuation Excel Model (Engineering and Construction)

Detailed Financial model for DCF valuation on Engineering and Construction Company1,0661add_shopping_cart$120.00 by Fin-Wiser Advisory

by Fin-Wiser Advisory