Last version published: 14/12/2016 11:00

Publication number: ELQ-19773-2

View all versions & Certificate

Three-Stage Free Cash Flow to Equity (FCFE) Discount Model

Value the equity in a firm with three stages of growth

Prof. Aswath Damodaran offers you this Best Practice for free!

download for free

Add to bookmarks

Further information

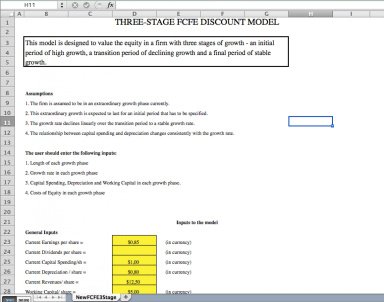

Outputs for each phase:

Growth rate

FCFE

Cost of Equity

Present Value

Assumptions in the model:

1. The firm is assumed to be in an extraordinary growth phase currently.

2. This extraordinary growth is expected to last for an initial period that has to be specified.

3. The growth rate declines linearly over the transition period to a stable growth rate.

4. The relationship between capital spending and depreciation changes consistently with the growth rate.

-Best suited for firms with three-stage growth