Originally published: 16/05/2018 05:54

Last version published: 03/07/2018 07:49

Publication number: ELQ-94864-2

View all versions & Certificate

Last version published: 03/07/2018 07:49

Publication number: ELQ-94864-2

View all versions & Certificate

Compounding Investments Excel Calculator

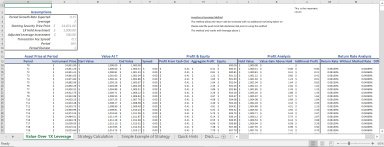

This excel model allows you measure the increase in ROI you can receive by compounding in investments

Description

This calculator can be easily edited to adjust the leverage you are using, the compounding timescale and the starting price of an instrument. It is simple to use and will allow you estimate the additional gains you can get over a simple 1X hold and implementing a 2X compouding strategy for example.

Compounding is the process of generating more return on an asset's reinvested earnings. To work, it requires two things: the reinvestment of earnings and time. Compound interest can help your initial investment grow exponentially. For younger investors, it is the greatest investing tool possible, and the #1 argument for starting as early as possible. Below we give a couple of examples of compound interest.

Example #1: Apple stock

An investment of $10,000 in the stock of Apple (AAPL) that was made on December 31, 1980 would have grown to $2,709,248 as of the market’s close on February 28, 2017 according to Morningstar’s Advisor Workstation tool. This translates to an annual return of 16.75%, including the reinvestment of all dividends from the stock.

Apple started paying dividends in 2012. Even so, if those dividends hadn’t been reinvested the ending balance of this investment would have been $2,247,949 or 83% of the amount that you would have had by reinvesting.

While Apple is one of the most successful companies, and their stock is a winner year-in and year-out, compound interest also works for index funds, which are managed to replicate the performance of a major market index such as the S&P 500.

Example #2: Vanguard 500 Index

Another example of the benefits of compounding is the popular Vanguard 500 Index fund (VFINX) held for the 20 years ending February 28, 2017.

A $10,000 investment into the fund made on February 28, 1997 would have grown to a value of $42,650 at the end of the 20-year period. This assumes the reinvestment of all fund distributions for dividends, interest or capital gains back into the fund.

Without reinvesting the distributions, the value of the initial $10,000 investment would have grown to $29,548 or 69% of the amount with reinvestment.

In this and the Apple example, current year taxes would have been due on any fund distributions or stock dividends if the investment was held in a taxable account, but for most investors, these earnings can grow tax-deferred in a retirement account such as a employer-sponsored 401(k).

Starting Early

Another way to look at the power of compounding is to compare how much less initial investment you need if you start early to reach the same goal.

A 25-year-old who wishes to accumulate $1 million by age 60 would need to invest $880.21 each month assuming a constant return of 5%.

A 35-year-old wishing to accumulate $1 million by age 60 would need to invest $1,679.23 each month using the same assumptions.

A 45-year-old would need to invest $3,741.27 each month to accumulate the same $1 million by age 60. That’s almost 4 times the amount that the 25-year old needs. Starting early is especially helpful when saving for retirement, when putting aside a little bit early in your career can reap great benefits.

This calculator can be easily edited to adjust the leverage you are using, the compounding timescale and the starting price of an instrument. It is simple to use and will allow you estimate the additional gains you can get over a simple 1X hold and implementing a 2X compouding strategy for example.

Compounding is the process of generating more return on an asset's reinvested earnings. To work, it requires two things: the reinvestment of earnings and time. Compound interest can help your initial investment grow exponentially. For younger investors, it is the greatest investing tool possible, and the #1 argument for starting as early as possible. Below we give a couple of examples of compound interest.

Example #1: Apple stock

An investment of $10,000 in the stock of Apple (AAPL) that was made on December 31, 1980 would have grown to $2,709,248 as of the market’s close on February 28, 2017 according to Morningstar’s Advisor Workstation tool. This translates to an annual return of 16.75%, including the reinvestment of all dividends from the stock.

Apple started paying dividends in 2012. Even so, if those dividends hadn’t been reinvested the ending balance of this investment would have been $2,247,949 or 83% of the amount that you would have had by reinvesting.

While Apple is one of the most successful companies, and their stock is a winner year-in and year-out, compound interest also works for index funds, which are managed to replicate the performance of a major market index such as the S&P 500.

Example #2: Vanguard 500 Index

Another example of the benefits of compounding is the popular Vanguard 500 Index fund (VFINX) held for the 20 years ending February 28, 2017.

A $10,000 investment into the fund made on February 28, 1997 would have grown to a value of $42,650 at the end of the 20-year period. This assumes the reinvestment of all fund distributions for dividends, interest or capital gains back into the fund.

Without reinvesting the distributions, the value of the initial $10,000 investment would have grown to $29,548 or 69% of the amount with reinvestment.

In this and the Apple example, current year taxes would have been due on any fund distributions or stock dividends if the investment was held in a taxable account, but for most investors, these earnings can grow tax-deferred in a retirement account such as a employer-sponsored 401(k).

Starting Early

Another way to look at the power of compounding is to compare how much less initial investment you need if you start early to reach the same goal.

A 25-year-old who wishes to accumulate $1 million by age 60 would need to invest $880.21 each month assuming a constant return of 5%.

A 35-year-old wishing to accumulate $1 million by age 60 would need to invest $1,679.23 each month using the same assumptions.

A 45-year-old would need to invest $3,741.27 each month to accumulate the same $1 million by age 60. That’s almost 4 times the amount that the 25-year old needs. Starting early is especially helpful when saving for retirement, when putting aside a little bit early in your career can reap great benefits.

This Best Practice includes

1 Excel Workbook

Further information

To help investors predict the additional ROI they can receive with compounding

If you accurately predict the growth rate of an instrument

Recession