Last version published: 02/02/2018 14:49

Publication number: ELQ-43096-2

View all versions & Certificate

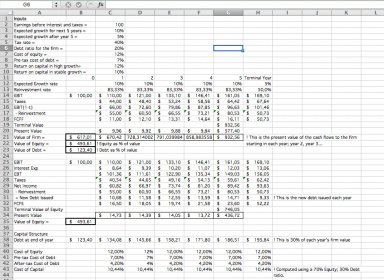

Valuation: Free Cash Flow to Firm (FCFF) vs Free Cash flow to Equity (FCFE) Excel Model

Excel Valuation model that reconciles FCFF (Free Cash Flow to the Firm) and FCFE (Free Cash Flow to Equity)

Prof. Aswath Damodaran offers you this Best Practice for free!

download for free

Add to bookmarks

Further information

Outputs:

- Value of Firm

- Value of Equity

- Value of Debt

- Cost of Equity

- Pre-tax Cost of Debt

- After-tax Cost of Debt

- Cost of Capital