Last version published: 13/04/2020 09:22

Publication number: ELQ-16910-3

View all versions & Certificate

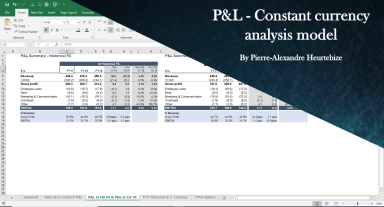

P&L (Profit & Loss) Constant Currency Analysis Excel Model

Best practice to assess the impact of FX on a P&L for a business trading in different currencies

Further information

Assess the impact of exchange rate variation on profitability. Separate transaction effect vs. translation effect.

Financial due diligence. Reporting. Multiple currency analysis. Understanding operations on a constant currency basis.