Originally published: 19/01/2024 16:12

Publication number: ELQ-90202-1

View all versions & Certificate

Publication number: ELQ-90202-1

View all versions & Certificate

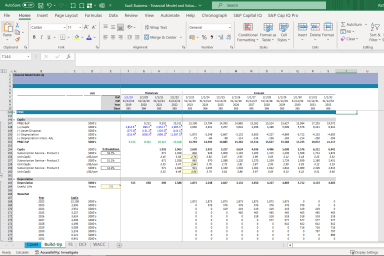

SaaS Company Financial Model and Valuation | Excel Template

Discover the SaaS Company Financial Model and Valuation, an essential tool designed to empower investors, entrepreneurs, stakeholders, finance enthusiasts, and

At Apollo Financial Models, we are a team of seasoned professionals with extensive backgrounds in private equity and investment banking. Our collective experience empowers us to deliver top-tier finanFollow

Team of seasoned professionals with extensive backgrounds in private equity and investment banking.Follow

saas companysubscription modelfinancial projectionsfinancial modelfinsncial projectionsvaluationexcel template

Description

Welcome to the Comprehensive SaaS Company Financial Model and Valuation, your ultimate solution for making well-informed investment decisions in the logistics industry. This meticulously crafted financial tool is designed to assist investors, entrepreneurs, and stakeholders in assessing logistics companies’ financial performance and growth prospects.

Key Features:

All-Inclusive Financial Insights: Our model offers a holistic overview by integrating Income Statements, Balance Sheets, and Cash Flow Statements, providing a comprehensive view of financial performance and position.

Precise Revenue Stream Analysis: Dive into detailed revenue streams, managing detailed assumptions including new users, churn and average revenue per user (ARPU). Experiment with pricing scenarios and contract terms to visualize potential revenue variations.

Thorough Operating Expense Breakdown: Our model incorporates various expenses (both fixed and variable). Modify these inputs to understand their effects on profitability.

Strategic Capital Expenditure Planning: Anticipate future growth with insights into capital expenditures for expansion, technology enhancements, etc.

Scenario Exploration: Gain insights into different scenarios by adjusting variables like market growth rates, pricing strategies, and operational efficiencies, helping you make informed strategic decisions.

Comprehensive Debt and Financing Analysis: Analyze the impact of debt and equity financing structures on the company’s financial health and capital structure.

Insightful Valuation Methods: Employ DCF valuation methodology to estimate the company’s intrinsic value.

Risk Assessment with Sensitivity Analysis: Evaluate key variables’ impact on valuation and identify critical drivers of value and potential areas of risk.

User-Friendly Interface: Our intuitive interface caters to users of varying financial expertise, ensuring easy navigation and interaction with the model.

Benefits:

Informed Decision-Making: Make strategic choices confidently with accurate financial projections and valuation insights.

Attract Investors: Present investor-friendly reports and comprehensive valuation analyses that enhance your company’s appeal to potential investors.

Mitigate Risks: Identify vulnerabilities and devise risk mitigation strategies with sensitivity analysis.

Tailored to Your Needs: Customize the model to match your SaaS company’s unique goals and characteristics.

Transparent and Reliable: The model showcases underlying assumptions and methodologies, promoting transparency in the valuation process.

Experience the power of the Comprehensive SaaS Company Financial Model and Valuation. Unlock precise financial projections, dynamic scenario analyses, and expert valuation methods to navigate the complexities of the software industry confidently. Elevate your engagement with potential investors and propel your software business forward with this template now!

Welcome to the Comprehensive SaaS Company Financial Model and Valuation, your ultimate solution for making well-informed investment decisions in the logistics industry. This meticulously crafted financial tool is designed to assist investors, entrepreneurs, and stakeholders in assessing logistics companies’ financial performance and growth prospects.

Key Features:

All-Inclusive Financial Insights: Our model offers a holistic overview by integrating Income Statements, Balance Sheets, and Cash Flow Statements, providing a comprehensive view of financial performance and position.

Precise Revenue Stream Analysis: Dive into detailed revenue streams, managing detailed assumptions including new users, churn and average revenue per user (ARPU). Experiment with pricing scenarios and contract terms to visualize potential revenue variations.

Thorough Operating Expense Breakdown: Our model incorporates various expenses (both fixed and variable). Modify these inputs to understand their effects on profitability.

Strategic Capital Expenditure Planning: Anticipate future growth with insights into capital expenditures for expansion, technology enhancements, etc.

Scenario Exploration: Gain insights into different scenarios by adjusting variables like market growth rates, pricing strategies, and operational efficiencies, helping you make informed strategic decisions.

Comprehensive Debt and Financing Analysis: Analyze the impact of debt and equity financing structures on the company’s financial health and capital structure.

Insightful Valuation Methods: Employ DCF valuation methodology to estimate the company’s intrinsic value.

Risk Assessment with Sensitivity Analysis: Evaluate key variables’ impact on valuation and identify critical drivers of value and potential areas of risk.

User-Friendly Interface: Our intuitive interface caters to users of varying financial expertise, ensuring easy navigation and interaction with the model.

Benefits:

Informed Decision-Making: Make strategic choices confidently with accurate financial projections and valuation insights.

Attract Investors: Present investor-friendly reports and comprehensive valuation analyses that enhance your company’s appeal to potential investors.

Mitigate Risks: Identify vulnerabilities and devise risk mitigation strategies with sensitivity analysis.

Tailored to Your Needs: Customize the model to match your SaaS company’s unique goals and characteristics.

Transparent and Reliable: The model showcases underlying assumptions and methodologies, promoting transparency in the valuation process.

Experience the power of the Comprehensive SaaS Company Financial Model and Valuation. Unlock precise financial projections, dynamic scenario analyses, and expert valuation methods to navigate the complexities of the software industry confidently. Elevate your engagement with potential investors and propel your software business forward with this template now!

This Best Practice includes

1 Excel File