Originally published: 25/11/2016 10:59

Publication number: ELQ-56438-1

View all versions & Certificate

Publication number: ELQ-56438-1

View all versions & Certificate

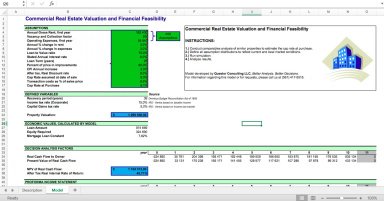

Commercial Real Estate Financial Model

Compute a Commercial Real Estate Valuation and Financial Feasibility of your Investment Project - excel model