Last version published: 02/02/2018 14:50

Publication number: ELQ-90266-2

View all versions & Certificate

Merger Synergy Valuation Excel Model

This Excel Model estimates the value of synergy in a merger.

Prof. Aswath Damodaran offers you this Best Practice for free!

download for free

Add to bookmarks

Further information

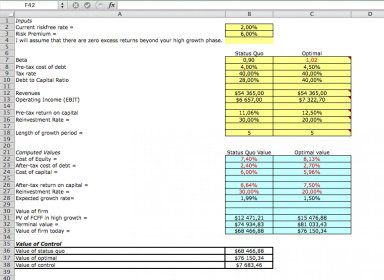

The objective of this model is to get the following output values for the acquiring firm, target firm and merged firm:

- Cost of Equity

- After-tax cost of debt

- Cost of capital

- After-tax return on capital

- Reinvestment rate

- Expected growth rate

- Present Value (PV) of Free Cash Flow for the Firm (FCFF) in high growth

- Terminal value

- Value of firm today

Value of synergy:

- value of independent firms

- value of combined firm

- value of synergy