Last version published: 16/06/2020 08:33

Publication number: ELQ-78459-4

View all versions & Certificate

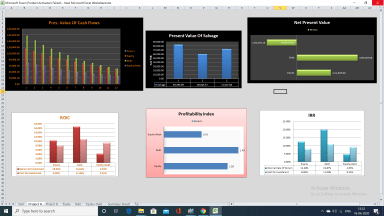

Capital Budgeting Excel Model

Should I pursue the project? Analyse your Investment Decision with this 4 tab Excel Template.

Further information

Project Decision

Decision Making, Project Analysis

Standalone