Originally published: 03/10/2023 07:49

Publication number: ELQ-23529-1

View all versions & Certificate

Publication number: ELQ-23529-1

View all versions & Certificate

IPO Financial Model Template

Our Generic Excel template allows users to easily adjust assumptions to quickly provide valuation, fully diluted shares, and scenario analysis.

At Apollo Financial Models, we are a team of seasoned professionals with extensive backgrounds in private equity and investment banking. Our collective experience empowers us to deliver top-tier finanFollow

Team of seasoned professionals with extensive backgrounds in private equity and investment banking.Follow

initial public offeringinvestment bankingipo modelipo templateequity offeringequity analysisfinancial modelfinancial modellingfinancial analysis

Description

Generic IPO Excel Template

Introduction: This Generic IPO Excel Model is a versatile and comprehensive tool designed to assist companies from various industries in preparing for an Initial Public Offering (IPO). Whether you’re in technology, healthcare, finance, or any other sector, this model offers valuable insights and calculations to guide your IPO decision-making process.

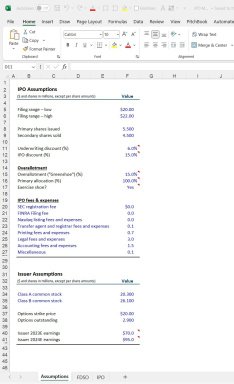

1. Assumptions Tab:

Filing Range: Start by specifying your desired IPO price range, offering valuable insight into potential market demand.

Shares Issued: Determine the number of primary and secondary shares to be issued, considering the company’s capital structure and objectives.

Overallotment: Include an overallotment option to account for potential oversubscription.

IPO Fees and Expenses: Estimate IPO-related costs, such as underwriting fees, legal fees, and other expenses.

Issuer Assumptions: Incorporate specific issuer assumptions, such as projected revenue growth, cost structures, and market conditions, to tailor the model to your industry.

2. Fully Diluted Shares Count Analysis Tab:

This tab provides a comprehensive analysis of fully diluted shares, taking into account various scenarios, such as employee stock options, convertible securities, and other potential dilution factors. It ensures a realistic understanding of post-IPO ownership distribution.

3. IPO Tab – Model Outputs:

Sensitivity Analysis: Explore a range of IPO prices and see how they impact the offering’s success. This feature helps you identify the optimal IPO price point.

Pro-forma Shares Analysis: Get a clear picture of the post-IPO capital structure, including the breakdown of ownership among shareholders.

Offering Size: Determine the size of your offering based on the desired capital raise and share price.

IPO Discount and Fees: Calculate the IPO discount, underwriting fees, legal fees, and other costs associated with going public.

IPO Proceeds: Understand how much capital your company will raise through the IPO.

Valuation Outputs: Evaluate the estimated post-IPO market capitalization and enterprise value, providing insights into your company’s perceived worth.

Versatility Across Industries: This Excel model is not industry-specific, making it suitable for companies in various sectors looking to go public. Its flexibility allows you to tailor assumptions and inputs to match the unique characteristics of your business.

In conclusion, the Generic IPO Excel Model is a comprehensive and adaptable tool that empowers companies to make informed decisions when considering an IPO. It provides a detailed analysis of assumptions, fully diluted shares, and various IPO outcomes, making it an invaluable resource for companies across different industries.

Generic IPO Excel Template

Introduction: This Generic IPO Excel Model is a versatile and comprehensive tool designed to assist companies from various industries in preparing for an Initial Public Offering (IPO). Whether you’re in technology, healthcare, finance, or any other sector, this model offers valuable insights and calculations to guide your IPO decision-making process.

1. Assumptions Tab:

Filing Range: Start by specifying your desired IPO price range, offering valuable insight into potential market demand.

Shares Issued: Determine the number of primary and secondary shares to be issued, considering the company’s capital structure and objectives.

Overallotment: Include an overallotment option to account for potential oversubscription.

IPO Fees and Expenses: Estimate IPO-related costs, such as underwriting fees, legal fees, and other expenses.

Issuer Assumptions: Incorporate specific issuer assumptions, such as projected revenue growth, cost structures, and market conditions, to tailor the model to your industry.

2. Fully Diluted Shares Count Analysis Tab:

This tab provides a comprehensive analysis of fully diluted shares, taking into account various scenarios, such as employee stock options, convertible securities, and other potential dilution factors. It ensures a realistic understanding of post-IPO ownership distribution.

3. IPO Tab – Model Outputs:

Sensitivity Analysis: Explore a range of IPO prices and see how they impact the offering’s success. This feature helps you identify the optimal IPO price point.

Pro-forma Shares Analysis: Get a clear picture of the post-IPO capital structure, including the breakdown of ownership among shareholders.

Offering Size: Determine the size of your offering based on the desired capital raise and share price.

IPO Discount and Fees: Calculate the IPO discount, underwriting fees, legal fees, and other costs associated with going public.

IPO Proceeds: Understand how much capital your company will raise through the IPO.

Valuation Outputs: Evaluate the estimated post-IPO market capitalization and enterprise value, providing insights into your company’s perceived worth.

Versatility Across Industries: This Excel model is not industry-specific, making it suitable for companies in various sectors looking to go public. Its flexibility allows you to tailor assumptions and inputs to match the unique characteristics of your business.

In conclusion, the Generic IPO Excel Model is a comprehensive and adaptable tool that empowers companies to make informed decisions when considering an IPO. It provides a detailed analysis of assumptions, fully diluted shares, and various IPO outcomes, making it an invaluable resource for companies across different industries.

This Best Practice includes

1 Excel

Apollo Financial Models offers you this Best Practice for free!

download for free

Add to bookmarks