Originally published: 03/08/2021 08:36

Last version published: 04/08/2021 08:52

Publication number: ELQ-81242-2

View all versions & Certificate

Last version published: 04/08/2021 08:52

Publication number: ELQ-81242-2

View all versions & Certificate

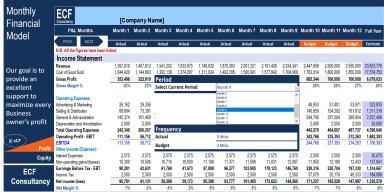

Monthly Financial Model Actual vs Budget-10Yr. plan & Valuation

Easy to use model, 100% customizable, no hidden formulas, clear to read and understand the reports and fully dynamic

monthly reportingratiosstrategical planbreak evenpaybackvaluationsensitive analysisscenario analysisvariancewacc

Description

General overview

The template has been constructed for monthly financial reporting for general trading industry,

It is incredibly simple to use that will lead you to monitor the financial performance and evaluate the future trends and decision.

The model follows best practice financial modelling principles and includes instructions and explanation

So, a quick overview of the model, in the contents sheet you can see the structure of the model and by clicking on any of the headlines will automatically redirected to the relevant sheet

In summary, the model easy to use, 100% customizable, no hidden formulas, clear to read and understand the reports and fully dynamic, the model shows the result on monthly basis,10 years financial plan with valuation and analysis, you need to select the current month on month basis in the first sheet, fill the data on monthly basis in the green cells in the sheet “Actual YTD” and fill data first time in the other green tabs, and the outputs are updated instantly,

Key inputs in the green tabs

Erase data from the green cells

Update the general info in the Front Page

Select the current month using the selection box in the "Front Page" sheet, column C, row 18

Fill the green cells only in the green tabs

The dark blue tabs are 100% linked

Input data to be done on monthly basis in the “Actual YTD” sheet

Key outcome in the dark blue tabs

The inputs in the green cells will dynamically flow into the following below:

Profit and loss statement by month including 3 major component, gross profit, EBITDA and net profit

Balance sheet by month including total assets, total liability and owners’ equity

Cash flow by month with 3 outputs such as operating cash flow, investing cash flow and financing cash flow

Ratios with 4 main components, such as profitability ratio, efficiency ratio, liquidity ratio and solvency ratio

Break-even point including value as well as margin of safety

Actual YTD vs budget YTD variance for profit and loss statement

Profit and loss statement for 10 years including 3 major component, gross profit, EBITDA and net profit

Balance sheet for 10 years including total assets, total liability and owners’ equity

Cash flow for 10 years with 3 outputs such as operating, investing, and financing cash flow

Ratios for 10 years with 4 main components, such as profitability, efficiency, liquidity and solvency ratio

Business valuation using discounted cash flow

Calculation for the WACC and capital required

Regular and discounted payback period

Dashboard summary

Conclusion and customization

This is a highly versatile, very sophisticated financial model template, and is also user-friendly.

If you have any inquiries, modification request or other requests of assistance to customize the model template for your business case please contact us here: https://www.eloquens.com/channel/ecorporatefinance

General overview

The template has been constructed for monthly financial reporting for general trading industry,

It is incredibly simple to use that will lead you to monitor the financial performance and evaluate the future trends and decision.

The model follows best practice financial modelling principles and includes instructions and explanation

So, a quick overview of the model, in the contents sheet you can see the structure of the model and by clicking on any of the headlines will automatically redirected to the relevant sheet

In summary, the model easy to use, 100% customizable, no hidden formulas, clear to read and understand the reports and fully dynamic, the model shows the result on monthly basis,10 years financial plan with valuation and analysis, you need to select the current month on month basis in the first sheet, fill the data on monthly basis in the green cells in the sheet “Actual YTD” and fill data first time in the other green tabs, and the outputs are updated instantly,

Key inputs in the green tabs

Erase data from the green cells

Update the general info in the Front Page

Select the current month using the selection box in the "Front Page" sheet, column C, row 18

Fill the green cells only in the green tabs

The dark blue tabs are 100% linked

Input data to be done on monthly basis in the “Actual YTD” sheet

Key outcome in the dark blue tabs

The inputs in the green cells will dynamically flow into the following below:

Profit and loss statement by month including 3 major component, gross profit, EBITDA and net profit

Balance sheet by month including total assets, total liability and owners’ equity

Cash flow by month with 3 outputs such as operating cash flow, investing cash flow and financing cash flow

Ratios with 4 main components, such as profitability ratio, efficiency ratio, liquidity ratio and solvency ratio

Break-even point including value as well as margin of safety

Actual YTD vs budget YTD variance for profit and loss statement

Profit and loss statement for 10 years including 3 major component, gross profit, EBITDA and net profit

Balance sheet for 10 years including total assets, total liability and owners’ equity

Cash flow for 10 years with 3 outputs such as operating, investing, and financing cash flow

Ratios for 10 years with 4 main components, such as profitability, efficiency, liquidity and solvency ratio

Business valuation using discounted cash flow

Calculation for the WACC and capital required

Regular and discounted payback period

Dashboard summary

Conclusion and customization

This is a highly versatile, very sophisticated financial model template, and is also user-friendly.

If you have any inquiries, modification request or other requests of assistance to customize the model template for your business case please contact us here: https://www.eloquens.com/channel/ecorporatefinance

This Best Practice includes

Excel Template