Last version published: 24/01/2017 10:44

Publication number: ELQ-34649-3

View all versions & Certificate

Redfin-Based Financial Model Template

Browse through Redfin.com's adaptable Financial Model. Find what brought it to success.

Further information

So what will you find in our model?

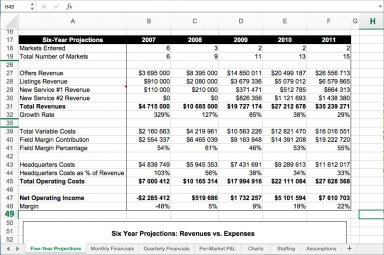

-One-page summary of earnings, capital expenses and cash balance

-Ratios of revenue and profits to employees and program expenses.

-Assumptions created to call out investors to evaluate dependencies.

-Assumption-driven formulas, so changes to the assumptions propagate through financial statements.

-Unit economics isolated on a separate page: for Redfin, this is how much profit each real estate market can generate.

- Charts of headcount growth, cash balance, earnings segmentation, revenue segmentation.

- Hiring detail with headcount and salary sums for each department.

The model also contains a few Redfin-built, custom Excel functions:

-Counting the number of employees in a department, by counting the number of times a department value like “Engineering” appears in a column.

-Summing the salaries of employees in a department, by adding up salaries for each employee where the department value for that employee equals a value like “Engineering.”

-Calculating how a Redfin market grows in revenue-capacity to reach maturity, and then grows more slowly thereafter.

-Calculating the number of support personnel needed to accommodate demand, and when those support personnel start. This allows us to update the staffing projection automatically when we change demand assumptions.

To get the custom functions to accommodate changes in the assumptions, you will have to set Excel’s macro security to “Low” (Tools | Macro | Security | Low). The file does not contain any malicious macros.

(Guy Kawasaki)

The layout of the model may help entrepreneurs that lack direction on where to start.

The model has been built by someone with no background in finance, so it may be flawed in many aspects.