Originally published: 09/12/2020 14:43

Publication number: ELQ-20921-1

View all versions & Certificate

Publication number: ELQ-20921-1

View all versions & Certificate

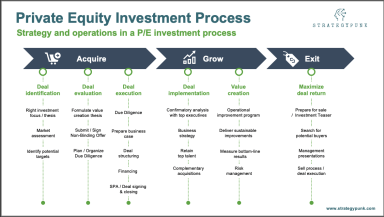

Private Equity Investment Process

Strategy and operations in a private equity investment process

Description

Private equity firms follow various steps to acquire, grow and exit an investment. The structured process can often vary from one another depending on the target as well as the nature of the transaction.

This powerpoint template is intended as a starting point on how the typical strategy and operations happens in a private equity investment process. This template needs to be adjusted depending on the deal and nature of the transaction.

Milestones and Key Steps

Deal identification

- Right investment focus / thesis

- Market assessment

- Identify potential targets

Deal evaluation

- Formulate value creation thesis

- Submit / Sign Non-Binding Offer

- Plan / Organize Due Diligence

Deal execution

- Due Diligence

- Prepare business case

- Deal structuring

- Define financing structure

- SPA & Deal signing / closing

Deal implementation

- Confirmatory analysis with top executives of the acquired company

- Business strategy

- Retain and attract top talent

- Complementary acquisitions (if required)

Value creation

- Operational improvement program

- Deliver sustainable improvements

- Measure bottom-line results

- Risk management

Maximize deal returns

- Prepare of sale with short & long investment teaser

- Search for potential buyers

- Management presentations

- Sell process and deal execution

If you find this tool useful, I kindly ask you to leave a positive review and rating. Leaving a review adds enthusiasm and motivation for me to create new tools.

Please feel free to drop me a message, if you have any questions regarding the tool.

Private equity firms follow various steps to acquire, grow and exit an investment. The structured process can often vary from one another depending on the target as well as the nature of the transaction.

This powerpoint template is intended as a starting point on how the typical strategy and operations happens in a private equity investment process. This template needs to be adjusted depending on the deal and nature of the transaction.

Milestones and Key Steps

Deal identification

- Right investment focus / thesis

- Market assessment

- Identify potential targets

Deal evaluation

- Formulate value creation thesis

- Submit / Sign Non-Binding Offer

- Plan / Organize Due Diligence

Deal execution

- Due Diligence

- Prepare business case

- Deal structuring

- Define financing structure

- SPA & Deal signing / closing

Deal implementation

- Confirmatory analysis with top executives of the acquired company

- Business strategy

- Retain and attract top talent

- Complementary acquisitions (if required)

Value creation

- Operational improvement program

- Deliver sustainable improvements

- Measure bottom-line results

- Risk management

Maximize deal returns

- Prepare of sale with short & long investment teaser

- Search for potential buyers

- Management presentations

- Sell process and deal execution

If you find this tool useful, I kindly ask you to leave a positive review and rating. Leaving a review adds enthusiasm and motivation for me to create new tools.

Please feel free to drop me a message, if you have any questions regarding the tool.

This Best Practice includes

1 PowerPoint Slide, 100% editable, 16x9 slide format