Originally published: 12/06/2019 10:26

Last version published: 04/02/2020 15:02

Publication number: ELQ-52289-2

View all versions & Certificate

Last version published: 04/02/2020 15:02

Publication number: ELQ-52289-2

View all versions & Certificate

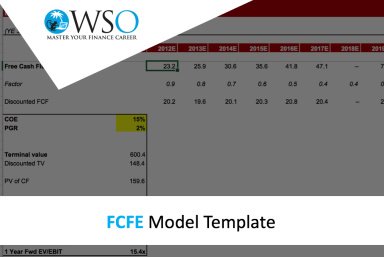

Free Cash Flow To Equity (FCFE) - Excel Model Template

Free Cash Flow to Equity (FCFE) model that gives unlevered free cash flow