Originally published: 09/01/2024 09:35

Publication number: ELQ-17653-1

View all versions & Certificate

Publication number: ELQ-17653-1

View all versions & Certificate

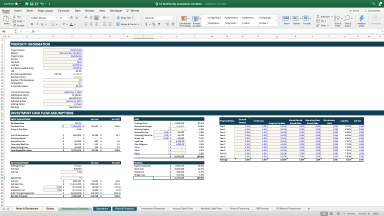

Multifamily Value Add Acquisition Model

Reposition, Refurbish, Add Units

multifamily real estatefinancial modelproperty financemultifamily acquisitionapartment acquisitionunderwritingirrreturn on investmentproformacash flow projection

Description

Value Add Multifamily Acquisition Financial Model/ Proforma

Please book an intro call with me, shall youhave any questions before downloading this model:

https://calendly.com/cre-analysis/intro-call

ABOUT THIS MODEL

This unlocked financial model is a work of art that has the following functionalitues:

- Fully dynamic with inputs specified as blue cells.

- Allows for Senior Loan, Bridge Financing, Mezz/Pref Equity Financing including I/O period and an option to choose between fixed or variable interest rate.

- Allows for sizing the Refinancing Loan based on minimum DSCR payment or maximum LTV with dynamic NOI for valuation (T12-F12).

- Detailed redevelopment/ refurbishment tab which aloows to run scenarios for either refurbishment of current units or adding new units to the property.

- Allows for re-evaluation of the Property Tax at a flexible date in the future. Allows to switch from %of Purchase Price to % of Capitalised Value.

- Exit NOI is dynamic based on T12, T6, T3, In Place, F3, F6, F12.

- Includes most common syndication fees.

- Has integrated waterfall with 4 hurdles.

- Has detailed monthly and annual cash flow.

- Has one page investment summary which can be printed out for review.

The model comes unlocked in both Excel and Google Sheet Formats.

Links to video guides will be provided very soon and will be available free of charge.

Shall you have any questions, please direct them to: [email protected]

ABOUT THE AUTHOR

Hi I am Oksana, seasoned Real Estate Private Equity Analyst for almost a decade now. Today I am building PFM – resource for prime real estate financial modeling templates.

I build models based on 6 main rules:

- Clarity (If you saw more clean real estate financial models than mine, please show me!)

- Reliability and Trust (Every good analyst was taught early that the tiniest error in calculations can make a difference to the success of the deal)

- Automation (How to make the least number of inputs to generate the largest number of outputs?)

- Quality (I build institutional grade models)

- Elegance (I would love for you to feel proud showing your deal to potential investors or bank. If you still use the model you wish no one have ever seen, STOP!)

- Ease of Use (Time matters. The easier it is to generate the economics of the deal, the better)

Shall you have any requrests regarding the new models, please direct message me.

Value Add Multifamily Acquisition Financial Model/ Proforma

Please book an intro call with me, shall youhave any questions before downloading this model:

https://calendly.com/cre-analysis/intro-call

ABOUT THIS MODEL

This unlocked financial model is a work of art that has the following functionalitues:

- Fully dynamic with inputs specified as blue cells.

- Allows for Senior Loan, Bridge Financing, Mezz/Pref Equity Financing including I/O period and an option to choose between fixed or variable interest rate.

- Allows for sizing the Refinancing Loan based on minimum DSCR payment or maximum LTV with dynamic NOI for valuation (T12-F12).

- Detailed redevelopment/ refurbishment tab which aloows to run scenarios for either refurbishment of current units or adding new units to the property.

- Allows for re-evaluation of the Property Tax at a flexible date in the future. Allows to switch from %of Purchase Price to % of Capitalised Value.

- Exit NOI is dynamic based on T12, T6, T3, In Place, F3, F6, F12.

- Includes most common syndication fees.

- Has integrated waterfall with 4 hurdles.

- Has detailed monthly and annual cash flow.

- Has one page investment summary which can be printed out for review.

The model comes unlocked in both Excel and Google Sheet Formats.

Links to video guides will be provided very soon and will be available free of charge.

Shall you have any questions, please direct them to: [email protected]

ABOUT THE AUTHOR

Hi I am Oksana, seasoned Real Estate Private Equity Analyst for almost a decade now. Today I am building PFM – resource for prime real estate financial modeling templates.

I build models based on 6 main rules:

- Clarity (If you saw more clean real estate financial models than mine, please show me!)

- Reliability and Trust (Every good analyst was taught early that the tiniest error in calculations can make a difference to the success of the deal)

- Automation (How to make the least number of inputs to generate the largest number of outputs?)

- Quality (I build institutional grade models)

- Elegance (I would love for you to feel proud showing your deal to potential investors or bank. If you still use the model you wish no one have ever seen, STOP!)

- Ease of Use (Time matters. The easier it is to generate the economics of the deal, the better)

Shall you have any requrests regarding the new models, please direct message me.

This Best Practice includes

1 Unlocked Excel File, 1 Unlocked Google Sheets File

Further information

Analyze multifamily acquisition opportunity, property underwriting

Real estate financial analysis