Originally published: 03/10/2016 17:15

Last version published: 03/10/2016 17:16

Publication number: ELQ-60800-2

View all versions & Certificate

Last version published: 03/10/2016 17:16

Publication number: ELQ-60800-2

View all versions & Certificate

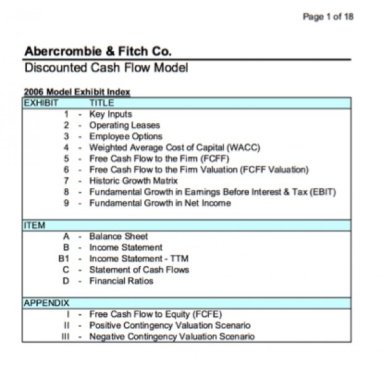

Abercrombie & Fitch Valuation Model

A full PDF of an Excel Valuation Model created for fundamental analysis of Abercrombie & Fitch ($ANF) in 2006