Last version published: 02/02/2018 14:50

Publication number: ELQ-99702-2

View all versions & Certificate

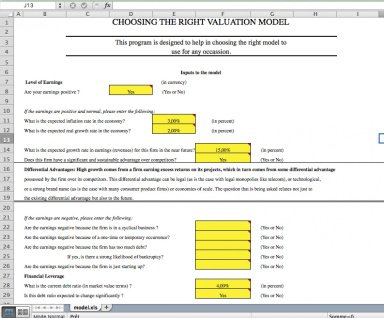

Discounted Cash Flow (DCF) Excel Model

This DCF Excel Model provides a rough guide to which discounted cash flow model may be best suited to your firm.

Prof. Aswath Damodaran offers you this Best Practice for free!

download for free

Add to bookmarks

Further information

The objective of this DCF Discounted Cash Flow model is to help you decide if you need to use a discounted Cash Flow Model or an Option Pricing Model for your valuation. It will also help you decide on the the level of earnings to use in the model (Current, Normalized), Cashflows that should be discounted (Dividends, FCFE, FCFF), Length of Growth Period (10 or more, 5 to 10, less than 5) and the appropriate growth pattern (Stable, 2 stage, 3 stage)