Publication number: ELQ-11966-1

View all versions & Certificate

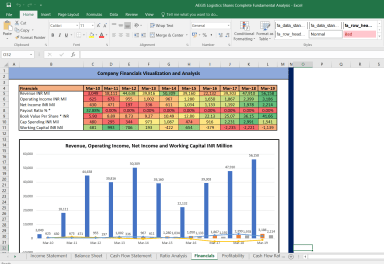

AEGIS Logistics Fundamental Analysis and Financial Ratios

Fundamental Analysis in Microsoft Excel of AEGIS Logistics Shares.

Further information

The aim is to provide a thorough outlook into the company's financial position. This will help the students in projects and learning fundamental analysis. This can also be used by Investors who are looking to do their own due diligence before investing in the Indian Stock Markets

Equity Research, Fundamental Analysis, Valuation, Long Term Investing