Last version published: 02/02/2018 14:50

Publication number: ELQ-93124-2

View all versions & Certificate

Value of Control in a Firm - Excel Model

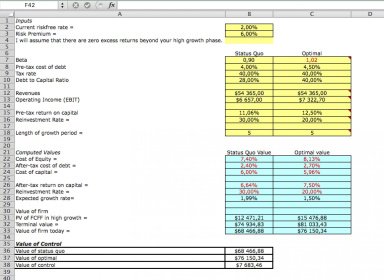

This Excel model analyzes the value of control in a firm.

Prof. Aswath Damodaran offers you this Best Practice for free!

download for free

Add to bookmarks

Further information

The objective of this model is to get the following output values for a firm:

- Cost of Equity

- After-tax cost of debt

- Cost of capital

- After-tax return on capital

- Reinvestment rate

- Expected growth rate

- Value of Firm

- Present Value (PV) of Free Cash Flow for Firm (FCFF) in high growth

- Terminal Value

- Value of Firm Today

Value of Control:

- Value of Status Quo

- Value of Optimal

- Value of Control