Originally published: 28/09/2016 20:58

Publication number: ELQ-21834-1

View all versions & Certificate

Publication number: ELQ-21834-1

View all versions & Certificate

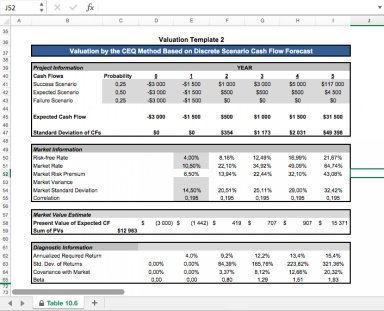

CEQ Method Valuation Model

Valuation by the CEQ Method based on Discrete Scenario Cash Flow Forecast