Originally published: 03/10/2023 07:52

Publication number: ELQ-60505-1

View all versions & Certificate

Publication number: ELQ-60505-1

View all versions & Certificate

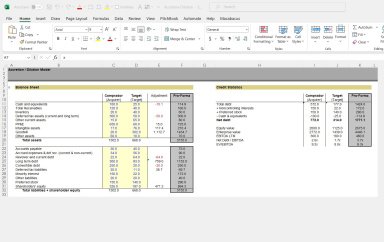

Accretion-Dilution Model Template

The Accretion-Dilution Model Template assesses the impact of acquisitions on earnings per share (EPS), analysing if a deal generates value.

At Apollo Financial Models, we are a team of seasoned professionals with extensive backgrounds in private equity and investment banking. Our collective experience empowers us to deliver top-tier finanFollow

Team of seasoned professionals with extensive backgrounds in private equity and investment banking.Follow

accretion / dilutioninvestment bankingfinancial modelfinancial modelingfinancial analysismerger modelmerger analysisaccretion-dilution modeltemplate

Description

Accretion-Dilution Financial Model Template:

Introduction: The Accretion-Dilution Financial Model is a powerful tool designed to assist organizations in evaluating the financial impact of potential mergers and acquisitions (M&A) transactions. This model is particularly valuable in strategic decision-making by assessing whether a proposed deal will result in accretion (increased earnings per share or EPS) or dilution (reduced EPS) for the acquiring company.

Key Features:

Detailed Assumptions: The model starts with a comprehensive input section where you can define the assumptions for the target company’s financials, the purchase price, financing terms, and integration costs. These assumptions form the foundation of the analysis.

Sensitivity Analysis: The heart of this model lies in its ability to perform sensitivity analysis. By varying key parameters, such as revenue growth, cost synergies, or financing terms, you can evaluate multiple scenarios to understand how changes impact the accretion or dilution effect. This provides critical insights into the deal’s sensitivity to various factors.

Pro Forma Analysis: The pro forma analysis section calculates the combined financials of the acquiring and target companies post-acquisition. This includes pro forma revenue, expenses, and EPS. It allows you to visualize the financial impact of the merger and determine whether it aligns with your strategic goals.

Accretion-Dilution Analysis: The model calculates the accretion or dilution in EPS resulting from the M&A transaction. This is a pivotal metric in assessing the value creation potential of the deal. Positive accretion indicates the deal may enhance shareholder value, while dilution suggests a potential decrease in value.

Scenario Planning: This model enables you to create various scenarios, considering different assumptions and potential outcomes. By doing so, you can make informed decisions based on a range of possibilities, reducing risks associated with M&A.

Decision-Making Tool: The Accretion-Dilution Financial Model serves as a decision-making compass for M&A activities. It empowers executives, finance professionals, and dealmakers to quantify and visualize the financial implications of proposed acquisitions, aiding in strategic alignment and risk mitigation.

Conclusion: In summary, the Accretion-Dilution Financial Model combines detailed assumptions, sensitivity analysis, and pro forma analysis to provide a comprehensive view of the financial impact of M&A transactions. This versatile tool is essential for organizations seeking to make informed decisions about potential acquisitions and their impact on earnings and shareholder value.

Accretion-Dilution Financial Model Template:

Introduction: The Accretion-Dilution Financial Model is a powerful tool designed to assist organizations in evaluating the financial impact of potential mergers and acquisitions (M&A) transactions. This model is particularly valuable in strategic decision-making by assessing whether a proposed deal will result in accretion (increased earnings per share or EPS) or dilution (reduced EPS) for the acquiring company.

Key Features:

Detailed Assumptions: The model starts with a comprehensive input section where you can define the assumptions for the target company’s financials, the purchase price, financing terms, and integration costs. These assumptions form the foundation of the analysis.

Sensitivity Analysis: The heart of this model lies in its ability to perform sensitivity analysis. By varying key parameters, such as revenue growth, cost synergies, or financing terms, you can evaluate multiple scenarios to understand how changes impact the accretion or dilution effect. This provides critical insights into the deal’s sensitivity to various factors.

Pro Forma Analysis: The pro forma analysis section calculates the combined financials of the acquiring and target companies post-acquisition. This includes pro forma revenue, expenses, and EPS. It allows you to visualize the financial impact of the merger and determine whether it aligns with your strategic goals.

Accretion-Dilution Analysis: The model calculates the accretion or dilution in EPS resulting from the M&A transaction. This is a pivotal metric in assessing the value creation potential of the deal. Positive accretion indicates the deal may enhance shareholder value, while dilution suggests a potential decrease in value.

Scenario Planning: This model enables you to create various scenarios, considering different assumptions and potential outcomes. By doing so, you can make informed decisions based on a range of possibilities, reducing risks associated with M&A.

Decision-Making Tool: The Accretion-Dilution Financial Model serves as a decision-making compass for M&A activities. It empowers executives, finance professionals, and dealmakers to quantify and visualize the financial implications of proposed acquisitions, aiding in strategic alignment and risk mitigation.

Conclusion: In summary, the Accretion-Dilution Financial Model combines detailed assumptions, sensitivity analysis, and pro forma analysis to provide a comprehensive view of the financial impact of M&A transactions. This versatile tool is essential for organizations seeking to make informed decisions about potential acquisitions and their impact on earnings and shareholder value.

This Best Practice includes

1 Excel