Originally published: 13/07/2021 12:15

Publication number: ELQ-79843-1

View all versions & Certificate

Publication number: ELQ-79843-1

View all versions & Certificate

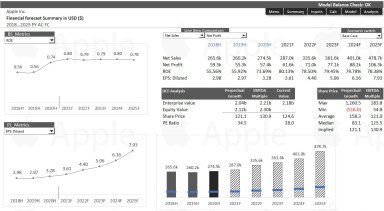

Apple Inc. Corporate Finance Modeling & DCF Valuation

A corporate financial Model & Valuation for Apple Inc.