Publication number: ELQ-32315-1

View all versions & Certificate

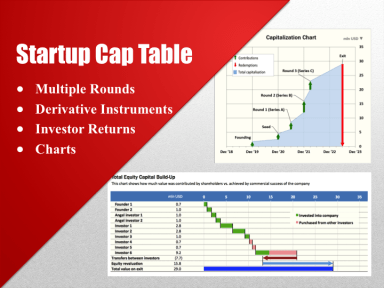

Cap Table with Derivative Instruments, Investor Returns and Charts

Advanced multiple round startup cap table

Further information

Calculate every participant's share in a JV startup at every round, analyze potential dilutive effect of derivative instruments, present the results graphically

You have a startup with several investors joining in multiple rounds

If your JV's capital structure is more complex than what this model includes; contact me if you need help creating a cap table for your situation