Originally published: 12/11/2021 08:56

Publication number: ELQ-19657-1

View all versions & Certificate

Publication number: ELQ-19657-1

View all versions & Certificate

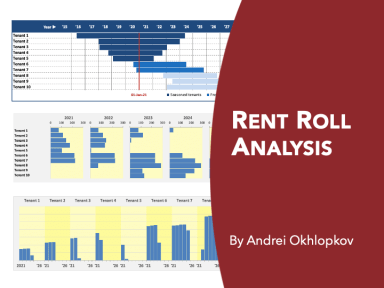

Rent Roll Analysis

Analysis of existing and prospective tenants and their lease conditions in commercial real estate

Description

A rent roll is a table listing the tenants of a real estate asset, showing how much area they occupy, rental rates they pay, duration of their rental agreements and other relevant information.

There can be different types of real estate assets: office buildings, retail centers, warehouses, residential apartment blocks. For any of these types a rent roll allows to estimate the financial performance of an asset: to see how much of its areas are leased, what the rental revenues and net operating income are, how they will be declining in the future (due to lease contract expirations), how many square meters will be vacated and when.

Having an accurate rent roll and a proper underlying analysis is important for anyone who needs a full picture of an asset:

-landlords and property managers

-investors, buyers and sellers in a potential transaction

-banks and financial institutions

-appraisers

-etc.

As the existing agreements approach their expiry dates, we start the discussions with prospective tenants. Their preliminary conditions are included into the rent roll and become part of the analysis. But, until the lease is signed, we need to keep in mind the uncertainty of having them as future tenants and to separate them in the analysis.

Furthermore, existing tenants can also be split into “seasoned” tenants (having a sufficient track record, e.g. over six months) and “fresh” tenants (who just came in recently and have not yet demonstrated their financial condition and discipline as tenants). Therefore, existing tenants are also separated into these categories in the analysis.

If you have a different classification of tenants or think some categories are not needed, you can change this in the model quite quickly.

The attached file contains a thorough rent roll analysis. It demonstrates how to perform the calculations and to visualize the results to show:

1. Areas occupied by every tenant and vacant areas

2. Rental revenues by tenant and by type of revenue, security deposits collected and released

3. Rental revenues by tenant and by year

4. Lease length by tenant, active tenants at any point in time

5. Rental areas, lease expirations, and rental rate by tenant category

6. Rented areas by tenant category at any point in time

7. Lease length by tenant, rented areas against the total occupancy (vacancy) of the building

The analysis has been developed primarily for office buildings but can be adapted to other types of real estate quickly. The model analyzes base rent, opex reimbursements, parking fees and security deposits. Rental rates can be adjusted annually by a specific index for each tenants in a certain month.

The calculations are done on a monthly basis and cover a period of six years but these are also flexible to change.

A rent roll is a table listing the tenants of a real estate asset, showing how much area they occupy, rental rates they pay, duration of their rental agreements and other relevant information.

There can be different types of real estate assets: office buildings, retail centers, warehouses, residential apartment blocks. For any of these types a rent roll allows to estimate the financial performance of an asset: to see how much of its areas are leased, what the rental revenues and net operating income are, how they will be declining in the future (due to lease contract expirations), how many square meters will be vacated and when.

Having an accurate rent roll and a proper underlying analysis is important for anyone who needs a full picture of an asset:

-landlords and property managers

-investors, buyers and sellers in a potential transaction

-banks and financial institutions

-appraisers

-etc.

As the existing agreements approach their expiry dates, we start the discussions with prospective tenants. Their preliminary conditions are included into the rent roll and become part of the analysis. But, until the lease is signed, we need to keep in mind the uncertainty of having them as future tenants and to separate them in the analysis.

Furthermore, existing tenants can also be split into “seasoned” tenants (having a sufficient track record, e.g. over six months) and “fresh” tenants (who just came in recently and have not yet demonstrated their financial condition and discipline as tenants). Therefore, existing tenants are also separated into these categories in the analysis.

If you have a different classification of tenants or think some categories are not needed, you can change this in the model quite quickly.

The attached file contains a thorough rent roll analysis. It demonstrates how to perform the calculations and to visualize the results to show:

1. Areas occupied by every tenant and vacant areas

2. Rental revenues by tenant and by type of revenue, security deposits collected and released

3. Rental revenues by tenant and by year

4. Lease length by tenant, active tenants at any point in time

5. Rental areas, lease expirations, and rental rate by tenant category

6. Rented areas by tenant category at any point in time

7. Lease length by tenant, rented areas against the total occupancy (vacancy) of the building

The analysis has been developed primarily for office buildings but can be adapted to other types of real estate quickly. The model analyzes base rent, opex reimbursements, parking fees and security deposits. Rental rates can be adjusted annually by a specific index for each tenants in a certain month.

The calculations are done on a monthly basis and cover a period of six years but these are also flexible to change.

This Best Practice includes

1 Excel file

Further information

Analyze existing and prospective tenants in commercial real estate

A multi-tenant commercial real estate asset of any kind (office, retail, warehouse, residential)

n/a