Last version published: 08/04/2021 16:22

Publication number: ELQ-33616-6

View all versions & Certificate

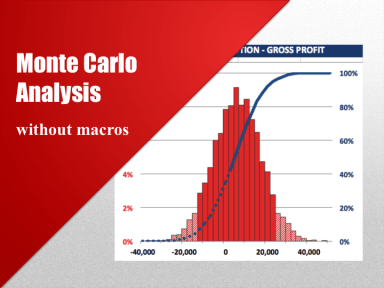

Monte Carlo Analysis (without macros) Excel Model

This post explains how to run full Monte Carlo analysis in Excel without macros

Further information

Perform sensitivity analysis in situations of uncertainty or limited input data

Financial modelling in situations involving uncertainty

None