Originally published: 27/04/2018 14:04

Last version published: 16/10/2018 09:18

Publication number: ELQ-82428-2

View all versions & Certificate

Last version published: 16/10/2018 09:18

Publication number: ELQ-82428-2

View all versions & Certificate

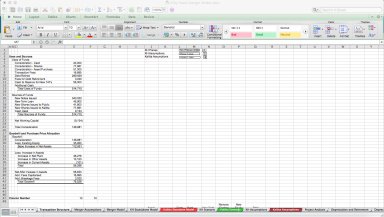

How to combine two standalone excel models to create a Merger Model

Video and 2 Excel files that help you know how to combine two models and create a merger model.