Publication number: ELQ-10170-1

View all versions & Certificate

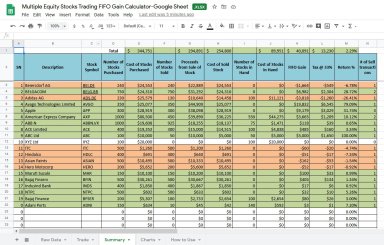

Multiple Equity Stocks Trading FIFO Gain Google Sheet Calculator

Very handy Google Sheet Calculator to calculate trading profits for multiple stocks in single sheet using FIFO method.

Further information

To calculate trading profit using FIFO method for various stocks together in a single sheet

To calculate stocks valuation using FIFO method and calculate profit or loss in trading